Apex Trader Funding Leverage

10% off first order: PROP10

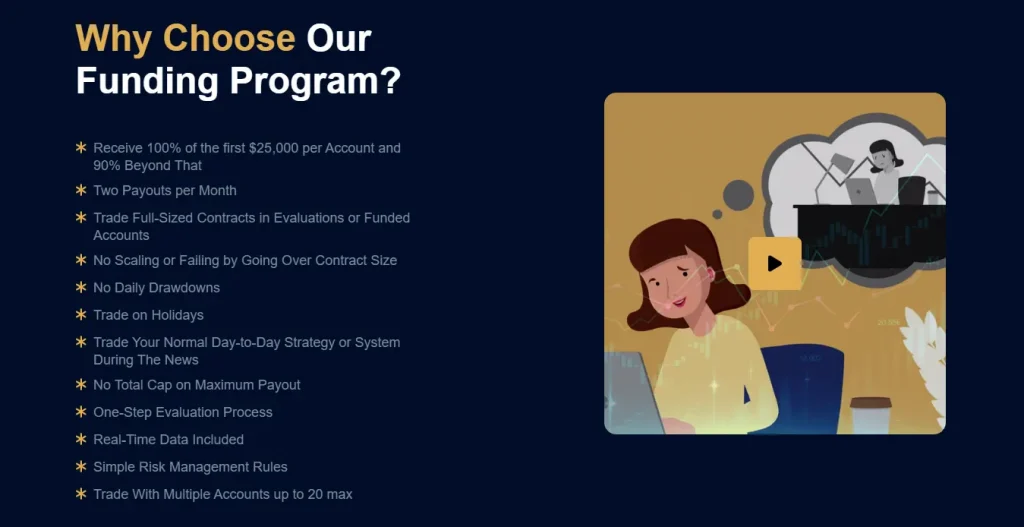

At Apex Trader Funding, we take a unique approach to leverage. Our system is designed to provide traders with ample opportunity while maintaining responsible risk management. This article explains our leverage policy, its implementation, and how it affects your trading.

Apex Leverage Explained

Leverage in trading allows you to control larger positions with a smaller amount of capital. At Apex Trader Funding, we structure our leverage differently from traditional brokers.

Key points:

- No fixed leverage ratio (e.g., 1:10, 1:50)

- Buying power equals account balance (1:1 leverage)

- Position limits based on account size

Our Leverage Model

Instead of a typical leverage ratio, we use a contract-based system:

- Maximum number of contracts allowed varies by account size

- Buying power equals the full account balance

- Risk management through contract limits, not margin requirements

Contract Limits by Account Size

| Account Size | Max Contracts | Micro Contracts |

| $25,000 | 4 | 40 |

| $50,000 | 10 | 100 |

| $75,000 | 12 | 120 |

| $100,000 | 14 | 140 |

| $150,000 | 17 | 170 |

| $250,000 | 27 | 270 |

| $300,000 | 35 | 350 |

How It Works

Example: $100,000 Account

- Full $100,000 available as buying power

- Maximum 14 standard contracts or 140 micro contracts

- Trade any combination within these limits

- No traditional margin calculations required

Benefits of Our Leverage Approach

- Simplified risk management

- No margin calls

- Clear position limits

- Reduced risk of overtrading

- Focus on trading skill, not leverage manipulation

Risk Management

Our leverage model incorporates risk management:

- Automatic position limiting

- System prevents exceeding max contracts

- Protects against accidental overtrading

- No overnight positions

- Reduces exposure to gap risk

- Ensures daily account reconciliation

- Trailing threshold

- Dynamically adjusts maximum drawdown

- Protects profits as they accumulate

Apex Trader Funding Leverage Across Instruments

Our leverage model applies consistently across all tradable instruments:

- Equity Futures

- Currency Futures

- Commodity Futures

- Interest Rate Futures

- Cryptocurrency Futures

Each instrument adheres to the same contract limits based on account size.

Leverage and Account Types

Our leverage model applies to both evaluation and funded accounts:

- Evaluation Accounts

- Same contract limits as funded accounts

- Helps simulate real trading conditions

- Funded Accounts

- Maintain same limits after passing evaluation

- Consistency between evaluation and live trading

Comparing to Traditional Leverage

Traditional Broker:

- Fixed leverage ratio (e.g., 1:50)

- Margin requirements

- Potential for margin calls

Apex Trader Funding:

- Contract-based limits

- Full account balance as buying power

- No margin calls

Scaling and Leverage

While we don’t offer traditional scaling plans, traders can increase their leverage by:

- Managing multiple accounts (up to 20)

- Upgrading to larger account sizes after consistent performance

Platform Integration

Our leverage rules are integrated into supported trading platforms:

- NinjaTrader

- Tradovate

- TradingView

- Rithmic

- Sierra Chart

- ATAS

- Quantower

Each platform enforces contract limits automatically.

Leverage and Trading Styles

Our leverage model accommodates various trading styles:

- Day Trading

- Utilize full buying power within trading hours

- Close all positions by end of day

- Scalping

- Quick entries and exits

- Contract limits prevent overtrading

- Swing Trading

- Not supported due to overnight position restrictions

Leverage and Profit Targets

Understand how leverage affects profit targets:

- Larger positions can reach targets faster

- Increased risk with larger positions

- Balance between aggression and consistency

Monitoring Your Leverage

Track your position size and leverage usage:

- Trading platform position monitor

- Apex Trader Funding dashboard

- Daily account statements

Leverage Best Practices

- Start small, increase gradually

- Monitor your risk-to-reward ratio

- Use stop-losses consistently

- Avoid using maximum leverage constantly

- Practice on demo accounts first

Leverage Policy Updates

Our leverage policy may be updated to maintain market integrity:

- Changes communicated via email

- Updates posted on website

- Typically implemented with advance notice

Educational Resources

We provide resources to help you understand and use leverage effectively:

- Video tutorials

- Webinars on risk management

- Articles on effective position sizing

- One-on-one mentoring (additional fee may apply)

Compliance and Regulations

Our leverage model complies with industry regulations:

- CFTC guidelines

- NFA requirements

- Exchange-specific rules

User Reviews

- Mark T., Experienced Futures Trader:

“Apex Trader Funding’s leverage model is refreshingly straightforward. The contract-based limits make it easy to manage risk, and I appreciate not having to worry about margin calls. It’s allowed me to focus more on my trading strategy rather than complex leverage calculations.” - Sarah L., Day Trader:

“As someone who came from forex trading, I was initially skeptical about the contract-based system. However, I’ve found it to be more intuitive and less stressful. The automatic position limiting has saved me from a few potential mistakes, especially during volatile market conditions.” - Alex R., New to Futures:

“The leverage approach at Apex Trader Funding has been perfect for learning futures trading. The clear contract limits helped me understand position sizing, and the absence of traditional margin requirements made it easier to focus on developing my skills. The educational resources provided were also extremely helpful in understanding how to use leverage effectively.”

Emerging Issues

- Transition from Traditional Leverage Models

Some traders have reported difficulty adjusting to our contract-based system after using traditional leverage ratios.

Solution: We’ve created a comprehensive guide comparing our system to traditional leverage models. This guide is available in our learning center. Additionally, our support team offers one-on-one sessions to help traders understand and adapt to our leverage approach.

- Perceived Limitations on Smaller Accounts

A few traders with smaller account sizes have expressed concerns about limited trading opportunities due to lower contract limits.

Solution: We encourage traders to focus on consistent performance rather than position size. Our system is designed to promote responsible trading. We offer resources on effective trading strategies for smaller account sizes, emphasizing quality over quantity in trades.

- Platform-Specific Leverage Display

Occasional confusion has arisen due to differences in how leverage and buying power are displayed across various supported platforms.

Solution: We’re working with our platform partners to standardize the display of position limits and buying power. In the meantime, we’ve created platform-specific guides that explain how to interpret leverage information on each supported platform. These guides are available in our help center.

FAQ

Can I increase my leverage beyond the set contract limits?

No, the contract limits are fixed for each account size to ensure responsible risk management. However, you can trade up to 20 accounts simultaneously, effectively increasing your overall trading capacity.

How does the leverage model affect my profit potential compared to traditional brokers?

While our model may seem more restrictive, it’s designed to promote sustainable trading. Many traders find they can achieve similar or better results by focusing on quality trades rather than overleveraging. Our profit split structure (up to 90%) often compensates for any perceived limitations.

What happens if I accidentally exceed my contract limit?

Our system is designed to prevent exceeding contract limits automatically. If you attempt to place an order that would exceed your limit, the order will be rejected. This safeguard ensures you always stay within your account’s risk parameters.