Apex Trader Scaling Plan

10% off first order: PROP10

What Is the Apex Trader Scaling Plan?

The Apex Trader Scaling Plan is a set of rules that determine how many contracts a trader is allowed to use at any given time in a funded account. Initially, traders are limited to a reduced number of contracts. This limit is in place until the account reaches a minimum equity threshold defined by the scaling model.

Key Points

- The scaling plan only applies to funded (PA) accounts, not evaluations.

- Traders start with half the allowed contracts based on their account size.

- Full contract usage becomes available only when the account balance exceeds the trailing drawdown + $100.

- Scaling thresholds are specific to each account level.

This plan is designed to ensure that increased trading size is earned through proven account growth, not speculation or short-term gains.

Contract Scaling Limits by Account Size

The table below outlines how many contracts can be used at each phase, depending on account size:

Account Size | Initial Contracts | Max Contracts | Scaling Threshold (Balance Required) |

$25,000 | 2 | 4 | $26,600 |

$50,000 | 5 | 10 | $53,300 |

$100,000 | 7 | 14 | $103,100 |

$150,000 | 8 | 17 | $155,600 |

$250,000 | 13 | 27 | $256,600 |

$300,000 | 15 | 30 | $308,100 |

How the Scaling Threshold Works

The scaling threshold is calculated using the trailing drawdown level set for the account. Traders may only access the full number of contracts once the account balance exceeds:

(Trailing Drawdown) + $100

For example:

- A $50,000 account has a trailing drawdown of $2,500.

- To unlock 10 contracts, the trader must grow the account above $50,000 + $2,500 + $100 = $52,600.

Until this amount is met, the trader must stick to the reduced contract limit (in this case, 5).

Scaling Plan Enforcement

Apex monitors contract usage and balance thresholds automatically. Violating the scaling plan has consequences:

- First Violation: Warning and denied payout.

- Repeated Violations: Reset of the payout cycle or account suspension.

- Consistent Breaches: Permanent disqualification from funding eligibility.

There is no leeway for misunderstanding the rules. All active traders are expected to remain under their assigned contract caps unless the system confirms that the scaling threshold has been surpassed.

Comparison with Other Trading Rules

The scaling plan works in tandem with Apex Trader’s broader set of trading conditions. Below is a summary comparison to help clarify how it fits in:

Rule Type | Applies To | Purpose | Violation Result |

Scaling Plan | Funded Accounts | Control contract usage until proven growth | Payout denial or reset |

30% Consistency | Funded Accounts | Limit reliance on a single high-profit day | Payout delay |

Max Drawdown | All Accounts | Protect against excessive risk | Account termination |

Stop Loss Required | All Accounts | Ensure risk control on every trade | Warning or disqualification |

Supported Platforms and Limitations

The Apex Trader Scaling Plan is enforced across all supported trading platforms. These include:

- NinjaTrader 8

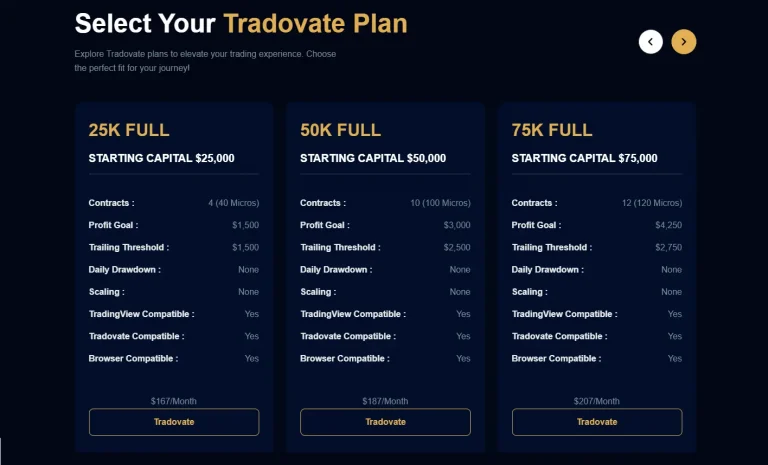

- Tradovate

- Rithmic (via R|Trader Pro)

- WealthCharts

Does Scaling Apply in Evaluations?

No. Evaluation accounts have fixed contract allocations. For example:

- $50K evaluation = 10 contracts

- $100K evaluation = 14 contracts

Traders can use all allotted contracts during the evaluation phase. However, once funded, they must revert to the scaled contract limits until their balance meets the scaling threshold.

Apex also supports connections to compatible platforms such as Sierra Chart, Jigsaw, and Quantower via Rithmic.

However, MetaTrader 5 (MT5) and cTrader are not supported. These platforms are mainly used for Forex and CFDs, which Apex does not offer.

Platform Support Summary

Platform | Supported | Scaling Applied | Notes |

NinjaTrader | Yes | Yes | Licensed via Apex |

Tradovate | Yes | Yes | Web/mobile compatible |

Rithmic | Yes | Yes | Primary data feed provider |

MT5 | No | Not applicable | Not supported |

cTrader | No | Not applicable | Not supported |

Final Notes on Trading Discipline

The Apex Trader Scaling Plan is not optional or advisory—it is a binding rule for all funded traders. Understanding how scaling ties into your account size, drawdown, and contract management is essential. Mismanaging this structure will result in payout denials and potential account termination. There are no exceptions or one-time forgiveness policies once a trader enters the funded phase.

This rule isn’t about restricting growth—it’s about proving that your trading behavior is consistent and scalable. And only then does Apex allow traders to increase exposure.

Conclusion

The Apex Trader Scaling Plan is a structured rule that connects contract permissions to real account growth. With initial limits set at 50% of the maximum contracts and unlocks triggered by balance thresholds, it ensures disciplined trading. It’s enforced across all compatible platforms, and violations lead to financial and access penalties.

For any trader entering a funded account with Apex, understanding the scaling plan is non-negotiable. It’s the line between payout eligibility and delay. Familiarizing yourself with your account size, scaling threshold, and contract rules should be part of your day-one checklist.

FAQ

When can I start using the full contract count in a funded account?

Only when your account balance exceeds your trailing drawdown by at least $100.

Does the scaling rule apply during the evaluation stage?

No. Evaluation accounts allow full contract usage without scaling limits.

What happens if I exceed the allowed number of contracts?

You may be issued a warning, have your payout denied, or be forced to reset your account.

Is the scaling plan enforced automatically?

Yes. Apex monitors contract usage and balance in real time.

Can I use MT5 or cTrader with Apex Trader Funding?

No. Apex does not support MT5 or cTrader, only futures-compatible platforms like NinjaTrader and Tradovate.