Apex Trader Rules

10% off first order: PROP10

Evaluation Phase Rules

The evaluation phase is the initial step every trader must complete to qualify for funding. The rules here are structured to assess trading behavior over a period of time—not just performance on a single day.

Basic Evaluation Requirements

- Minimum Trading Days:

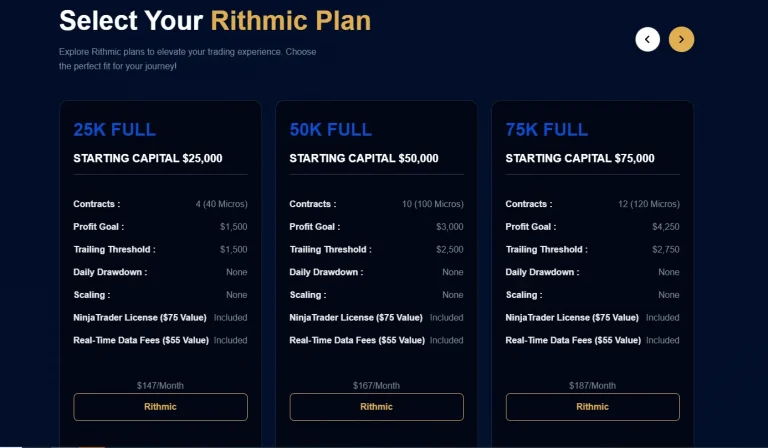

You must trade for at least seven unique trading days. These do not have to be consecutive but must be complete sessions with executed trades. - Profit Target:

Each evaluation account has a specific target based on account size. For instance, a $50,000 account may have a $3,000 profit goal. - Trailing Drawdown:

This is a dynamic risk limit that trails your highest unrealized balance. Exceeding it results in a failed evaluation. - No Daily Loss Limit:

Apex does not impose a daily stop-loss. However, this does not mean aggressive trading is acceptable—the trailing drawdown will still penalize risky activity. - Trade Closure Deadline:

All open trades must be closed, and working orders canceled by 4:59 PM Eastern Time. - Evaluation Reset Fee:

If you violate any rule, you must pay a fee ($80 for Rithmic, $100 for Tradovate) to reset your account.

Evaluation Parameters by Account Type

| Account Size | Profit Target | Trailing Drawdown | Min Days | Max Contracts | Reset Fee |

| $25,000 | $1,500 | $1,500 | 7 | 4 | $80-$100 |

| $50,000 | $3,000 | $2,500 | 7 | 10 | $80-$100 |

| $100,000 | $6,000 | $3,000 | 7 | 14 | $80-$100 |

Rules for Funded (Performance) Accounts

Once a trader passes evaluation, they’re transitioned into a funded (Performance) account. However, passing evaluation does not eliminate restrictions—it introduces new ones tied to payout eligibility and trading behavior.

Funded Account Conditions

- 30% Consistency Rule:

A single day’s profits can’t exceed 30% of total account profits at the time of payout request. Violating this resets your payout counter. - 30% Negative PnL Rule:

During a trading day, the worst open loss can’t exceed 30% of profits. This includes unrealized losses—so fast market spikes or poor stop placement can trigger a violation even if the day ends profitably. - Scaling Rule:

Upon funding, you may only use half the max contracts until your account balance exceeds the trailing drawdown by $100. For example, a $100,000 account with a $3,000 threshold requires a $3,100 balance to scale up. - No Trade Sharing:

Sharing login credentials or copying trades from one account to another is strictly prohibited. - Trade Closure Time:

Same as evaluation—no trades left open past 4:59 PM ET.

Scaling Eligibility Breakdown

| Account Size | Max Contracts | Start Limit | Full Use Threshold |

| $50,000 | 10 | 5 | $2,600 |

| $100,000 | 14 | 7 | $3,100 |

| $150,000 | 17 | 8 | $5,100 |

Risk Management Requirements

Trading with Apex requires more than meeting profit goals—it requires following operational safeguards that simulate responsible capital handling.

Enforced Risk Parameters

- Mandatory Stop-Loss:

Every trade must have a stop-loss. Absence of a defined stop-loss in your order will be treated as a rule violation, even if the trade was profitable. - Risk-Reward Ratio Limits:

The platform defines an acceptable risk-to-reward ratio of 5:1. This means your stop cannot be five times larger than your profit target. Constant violation of this rule could result in funding disqualification. - One-Direction Rule During News:

You’re permitted to trade around economic news but cannot flip between long and short positions during a news window. If caught, payouts can be denied. - Open Loss Management:

Avoid holding trades with large unrealized losses. A violation of the 30% Open PnL Rule often results in a strike against your account, affecting payout eligibility.

Platform and Technical Restrictions

While Apex supports platforms like Rithmic and Tradovate, they come with their own usage boundaries. Platform selection is final at account activation—you cannot switch platforms mid-evaluation or mid-performance account.

Platform Rules to Keep in Mind

- You must use only approved trading platforms linked through Apex’s license.

- Switching platforms requires starting a new evaluation.

- Each platform has different latency, order routing, and charting behaviors—study them.

Payout Rule Dependencies

Payouts are not automatic; you need to qualify for them. Apex ties payout eligibility directly to your compliance with account rules.Summary of Withdrawal Conditions

| Payout # | Max Allowed (e.g. $100K acct) | Conditions |

| 1-5 | $2,500 | Subject to 30% rule, scaling, drawdown buffer |

| 6+ | Unlimited | Must be rule-compliant |

Conclusion

Following the Apex Trader Rules is less about passing a test and more about maintaining structure. Traders who violate the rules—even unintentionally—can lose access to funding or have withdrawals denied. The platform operates on a strict rule set that simulates capital discipline, but this also creates narrow margins for error. The scaling rules, stop-loss enforcement, and payout limits are not flexible, and minor mistakes can result in major consequences.

If you’re looking for a relaxed trading environment, this may not be it. But if you’re aiming to build structured habits under constraints similar to those in institutional trading, the Apex Trader Rules deliver a very clear set of guidelines. You either comply—or reset.

FAQ

Can I start using all my allowed contracts immediately after funding?

No. You must keep usage at half capacity until your balance exceeds the trailing drawdown threshold by $100.

What happens if I don’t use a stop-loss on a trade?

Your account will be flagged. Repeated violations can disqualify you from receiving payouts or continuation in the program.

Can I withdraw profits even if I had one very strong trading day?

Only if that day’s gains do not exceed 30% of your total profit at the time of payout. Otherwise, you must trade more to normalize the average.

What is considered a breach of the open PnL rule?

Holding a position with unrealized losses greater than 30% of your total gains for the day—even briefly—can qualify as a breach.

Can I change my trading platform from Rithmic to Tradovate during evaluation?

No. Platform selection is final for that account. To switch, you must start a new evaluation on the new platform.